Make it a goal to live debt free

Charles Dickens so insightfully wrote: "Annual income twenty pounds, annual expenditures nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds aught and six, result misery."

One of the biggest obstacles to financial freedom is debt. If you have a lot of debt, you are basically a slave to it and to the person who owns the debt. The unfortunate thing is that many people get into this situation voluntarily. You slowly spend more than you earn and slowly (or not so slowly) build up a mountain that you can't get out from under.

I know it sounds impossible, but you should make it a goal to live debt free. Now, there are some people that can mange complicated debt and investment strategies, but for the vast majority of us, debt, and the ease of getting into debt, is an insidious poison. Here is my basic premise. If you cannot pay for something this month with cash, what is going to change next month that will enable you to pay for it? Can you really handle spending money at twice the rate with next month's salary to pay for the things you are charge this month and the things you will be charging next month?

One of the issues that hits people is something that I call, "unexpected miscellaneous big expenses". At one point, when I first was trying to figure out a financial plan and to try to eliminate my debt, I kept getting hit with what seemed to be surprises to me and that would completely destroy my budget for the month. One month it was the car DMV registration that I wasn't expecting. Then we had to renew insurance and the premium was higher than I expected. Then the washing machine broke down. Then we had a car repair that cost a lot more than planned. Then we this and that and this and that etc. etc. etc. It was really frustrating. How could I get out of debt if every month there is a "surprise" waiting for me? I started getting disheartened and started thinking that budgeting was a fantasy and would not work. Miscellaneous big expenses were completely disrupting my ability to try to set a budget.

I think a problem is that too many people put these expenses on a credit card thinking they will be able to pay them off easier over time. This is a double-whammy.

Here is one way I tackled this (I still use this strategy today).

I created a planning budget line-item called "MiscBigExpense" for all the miscellaneous big expenses that had been plaguing me. Then, I went back over the past months and I totaled up all the unexpected expenses. Then, I averaged them out for the year and created a spending plan that took into account that I would have these expenses. That meant that I had to cut back in other areas. Not as many dinners out. Maybe a few less movies and recreational activities. However, this was a key to building the right plan that would start to contain "shock" absorbers for the future. This is one of the fundamental principles that I want you to also adopt. Plan for the unexpected (actually, most of these things actually should not be unexpected, hence you should plan for them :-) ).

As I am re-reading what I have just written, there are a few things hidden between the lines.

1) Financial Automation with a computer. Quicken. I rely very heavily on Quicken. Quicken is a program that you can buy that is simply amazing. It will help you cut through and really manage your finances. I strongly urge you to use a financial tool such as Quicken or Microsoft Money. I am a serious power user of Quicken and I will detail specifics in the Blog on how I have done things with Quicken. I am sure the other financial packages can easily map to what I have done in Quicken. I think you are going to waste a lot of your time if you don't use a tool like this. I can go into more depth on this in a later post.

2) Budget: You have to build one up. Remember the 100's of books I told you that I read. Well, I can tell you that very consistently, almost every single one started off with: (1) figure out where you are (count up all your accounts and balances) and (2) build a budget.

So, back to debt. Get rid of it. It is terrible. Here are a couple of books that I recommend you read that outline both philosophical and practical steps to thinking about and reducing debt:

1) Your Money or Your Life

2) Nine Steps to Financial Freedom

Given I am new to blogging, I am not sure how much interest there is in the specific steps I took to get out of debt. I had a mountain of credit card bills and I developed some solid strategies and an approach that helped be crush the debt and move on to higher ground. Please let me know if you are interested in hearing more about the details to follow. financialfortress@yahoo.com

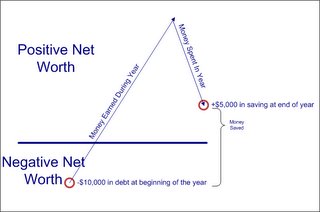

Here is a simple equation: (Money Earned) - (Money Spent) = (Money Saved)

I know it sounds simple, but it is an extremely important point. There simply is not a free ticket to getting out of debt and to saving money. You have two primary areas you can control. You probably have the most immediate control over (Money Spent). Next, you have control over (Money Earned) but is isn't as easy to move this one quickly.

Your goal, to eliminate debt, is to drive these numbers so that (Money Saved) is as high as possible every month so that you can apply that to bringing down your debt. Anyone who is pitching "get out of debt" fast strategies, or pushing "consolidation loans" should be kicked out of your life. These people are just trying to increase their own (Money Earned) :-) , but they want your money. Seriously, you can juggle accounts to manage interest rates, but DO NOT think things will get easier if you just get a consolidation loan. You need to go to the root of the issue and figure out how to get your income and expense in a fashion where you can start apply extra income to reducing your debt.

Look at the graph to the right. Let's say that you are starting this year off $10,000 in the hole. If you don't do anything to change, whatever practices you

are following will probably dig you deeper in debt through the year. Now, look out and calculate just how much you are going to have in income through the year. Income includes everything. The only way you are going to get out of debt is to ensure that you spend much less then you make.

are following will probably dig you deeper in debt through the year. Now, look out and calculate just how much you are going to have in income through the year. Income includes everything. The only way you are going to get out of debt is to ensure that you spend much less then you make.You should make getting rid a debt a high priority. Get passionate. Hate your debt. Think about all the ways you can get rid of it. Think of it as a terrible enemy that if you don't get eliminated it will cause years to try to catch up later. I guarantee you. If you focus your mind on a goal, you will be successful.

Increase Income:

The first thing you can do is increase income. Look around the house at all the junk you have accumulated. Think how many things in the house are not actually "yours" because you are still paying someone (the credit card company) for the privilege of borrowing these things. Unclutter your life and sell things you don't need and then use the money to pay down your debt. You will be amazed at what a liberating feeling this is. Also, remember, the more stuff you have, the more time and money you spend storing it.

More stuff means you need more space (perhaps more rent). Maybe you have a storage shed that you are renting somewhere for your important "stuff". Things cost money to maintain (a spare motorcycle, boat or other hobby equipment). Think of all the money you spent buying something, then how much time and money you might spend maintaining it. Do what you can to generate income quickly but shedding possessions that you do not really "need". You need to take a critical look at your priorities. Do you want to be working day-in and day-out to make money to pay interest so that the banker can have a nice house and a nice income? Or, do you want to start working for yourself and having your earnings be able to go to long-term goals and savings for YOU?! I think we know the answer. However, YOU have to change your habits to make this happen.

Decrease Spending: This is key. I will post more on this later.

In summary, debt management (and elimination) is part of the foundation to a financial fortress. You cannot have a financial fortress if the foundation to your castle is rotted out and hollow because you are overwhelmed with debt.

0 Comments:

Post a Comment

<< Home