Categorizing Income in Quicken: Creating and Using Spending Categorization (Part 2)

Hi,

When trying to use a budget, I strongly recommend that you use Quicken (or an equivalent tool). I use Quicken and my in-depth examples will assume you do as well.

First of all, it is much easier to work with a budget when it mirrors your real-life and the mental-model you have for your finances. For example, you should try to make the line-item for your income equal your monthly take-home page. That is, you probably thing about your monthly "income" in net terms (after all deductions for taxes, social security, 401k, etc.). Most budget programs default to have you just classify your income. Then, they capture all the taxes as a separate area. This makes it challenging as your "income" then looks massive (significantly higher than reality). Also, you need to make sure you net out and capture all your taxes. If you do it wrong, it will look like you have more (or less) than reality.

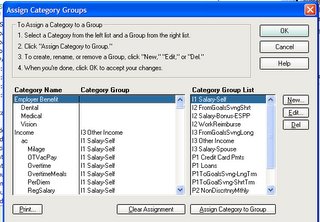

I have found it much easier to classify all the appropriate spending categories under an Salary Category Group. Quicken lets you define Category groups that "roll-up" a bunch of spending categories. Working with this higher-level category group makes it very easy.

My category groups are defined in this post:

Creating and Using Spending Categorization (Part 1)

Let me review the income categories and explain what I did.

Category Group: "I1 - Salary-Self"

This contains all the line-items on my monthly paycheck. It nets out to the amount of take-home pay I really have. For example, I mixed together income and expense categories.

I put in the following categories:

- Income:RegularSalary

- _401EmployerContrib (this is a Quicken Category)

- Insurance:AD&D

- Insurance:Dental

- Insurance:Disability

- Insurance:Medical

- Taxes:FedMe

- Taxes:Medicare

- Taxes:SocialSecurity

- Taxes:StateDI (State Disability)

a) I can set up my paycheck (my regular, non-variable part of my pay) and track the details.

b) I can accurately assess my tax situation later in the year (because I am tracking this)

c) I can "eyeball" by budget and tell that it is right (based on my takehome pay). This simplifies the process when you are building a budget.

d) I can "minimize" or roll-up this area. As long as I know the take-home is right, I don't need to spend time being distracted with these spending areas in my budget line-items. Putting them in here lets me ignore them later.

Category Group: "I2 - Salary Bonus-ESPP"

I put in more variable income categories here. The idea goes with the principle that I espoused in this write-up: Applying Physics to Financial Management

You want to minimize the variability in your budget. If you make money more periodically, or quarterly, REMOVE that from your budget tracking for your more steady income. The point being is that you want to make it easy to "eyeball" your budget as you work with it and ensure you don't have a mistake. It is a lot easier to see two line-items:

Regular Salary: $x,xxx

Bonus: $xxx

Some months you will have additional income. Some months you will not. By separating them, it makes it easier for you to not "forget" and have to keep clicking into the budget area to remember why this month salary was higher.

Also, it is easier to put savings plans in place as you enter the bonus. Whenever I have a higher amount coming in, I try to net it out by either increasing savings or increasing payments to a loan. This helps you do a better job meeting your goals. Otherwise, it is very easy to spend that extra money that lands in your account.

Category Group: "I2 Work Reimbursement"

I do the same thing. This might not apply to you, but periodically I have a set of things that I get reimbursed for (work travel for example). It is easier to "net" this out of your reports so that it does not look like you had a big income. Also, I use the same category both for the "expense" as well as the reimbursement "income" The idea is that this category: "Professional:Reimbursable" should net to zero through the year. If it isn't in a spending report, then that is a sign to go fix something.

Here is a clarification I want to add based on a similar discussion on the Quicken boards:

There are two tools in quicken. First, there are Categories (the "Category" field in every entry). These are the tied and true categories that everyone uses to track spending. You can see these by going to the menu item Tools->Category List (or hold down Shift+CTRL+C).There is a second classification area in Quicken called "Category Group". You can see this when you are creating or editing a category. Look in the dialog box for a field called "Category Group".What I am saying is that this allows you to "group" these smaller categories together. This is really useful in the budgeting process. In the budget tool in Quicken 2006, on the budget tab, look for a little check-box that says "Show Category Groups". This let's you see your budget at a much higher level. These are the category groups that I created. it is much easier to think of "income" in terms of you net-income than to have to create all the line-items in your budget for taxes, insurance, salary etc. With my method, you still created these, but they are bucketed together with the category group and you can roll-up and just see the category group line-item and not all the smaller categories.

1 Comments:

I'm new to Quicken and your advice is quite helpful. How would you handle a Health Care Flexible Spending Account (FSA)? In order to keep it simple, I'm tempted to use a category that contains both the "expense" (out of paycheck) transactions and the eventual "income" (reimbursement) transaction. Or should I create a seperate cash account for the FSA? Thanks!

Post a Comment

<< Home